VC Funding for Startups

Hope you might have gone through our previous write-up regarding Seed Funding. After seed funding, the next stage funding required for your startup is VC funding. A venture capitalist (VC) is an investor that gives funding to startups having high potential in return for an ownership stake. VCs have high chances of failure due to the risk involved with new and unproven startups at large scale.

Earlier, seed rounds were managed through angel investors, but the dispersal of cash- affluent VC funds and a mammoth range of startups to invest in has allured more venture capital firms also into seed round investment. If startups are getting seed funds from VCs, then its easy for them to raise next round of investment from the existing investor, if the objectives are fulfilled. Many times, the objectives are fulfilled with the raised seed funds, but still startups failed to be eligible for the next VC round. This is the stage where Angel Investors can play a role to bridge the gap.

Venture capital is mainly meant for later stage startups, it includes funding after seed stages. VC funding comes from the institutional investors or high net worth individuals and is managed together by investment firms. As the name says it all Venture capital involves risks as there is no guaranty of future profits and cash flow that’s why it is also called risk capital.

Different stages of VC Funding:

SERIES A

A typical, first stage of VC funds comes as Series A funding where revenue growth is the main game for startups. From here, startups are expected to have a clear picture of Product Market Fit, resulting into a significant revenue growth by acquiring more new customers and increasing Average Revenue per User.

“Flowspace Raises $12M in Series A Funding Led by Canvas Ventures”

To boost growth at a rapid pace, it’s necessary to implement new strategy & processes in Sales & marketing department, identify new channels, and retain existing customers through various loyalty programs.

Sometimes, angel Investors will invest in Series A rounds, but generally it’s the venture capital firms that lead this round.

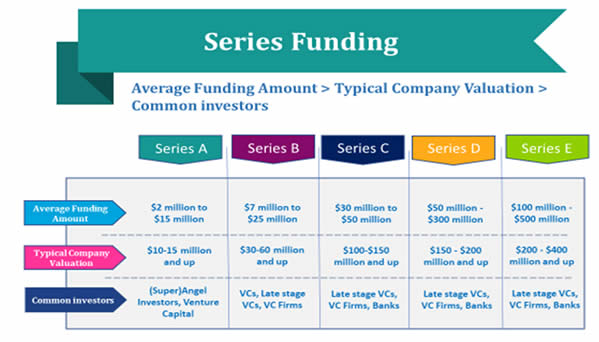

Average Funding Amount:$2 million to $ 15 million

Typical Company Valuation: $10-15 million and up

Common Investors:(Super)Angel Investors, Venture Capital

SERIES B

Previous funding rounds were fueled by a promising idea with valid POC/MVP, through early traction, through leading indicators of ProductMarket Fit and relatively growth potential.

Here, in Series B, investors will look for the next level of growth potential: the potential to scale whatever you have built till this stage.

“Aidoc Raises $27M in Series B Funding”

Practically,in this series of investment, a startup is to hire senior level of management team across the departments including business development, sales, marketing and finance to expand into different market segments or experiment with different revenue streams.In many other instances, businesses buy-out are considered that offer a competitive advantage in the market.

Average Funding Amount: $7 million to $25 million

Typical Company Valuation: $30-60 million and up

Common Investors: VCs, Late stage VCs, VC Firms

SERIES C

After Series B, to scale business on a large scale (new cities) or to kill the competition through buy-outs or for a market disruption, startups go for Series C investment. The purpose to raise money may vary based on the requirement of the startup.

“CloudGenix Raises $65M in Series C Funding”

Theoretically, there is no limit to raise the number of investment rounds until they have requirement & equity to dilute with the investors: Many Startups raise funds through Series D, E and beyond but relatively a low number of startups reach to this point.Amount raised in these rounds vary with startups, investors & their requirement. At this late stage, startupsare less risky, generating huge revenue with a proven capability for financial institutions to involve themselves in investment. Many Start-ups go for Initial public offering (IPO) and offer their shares to institutional investors and retail (individual) investors after this round.

Average Funding Amount: $30 million – $50 million

Typical Company Valuation: $100-150 million and up

Common Investors: Late stage VCs, VC Firms, Banks

SERIES D

As discussed above, mostly companies stop raising fundsafter Series C& plan to go for an IPO. However, some companies go for series D round of funding, which is generally a bit more complicated in comparison to the previous rounds.

“Lemonade Raises $300M in Series D Funding”

Average Funding Amount: $50 million – $300 million or more (amount varies widely from startup to startup)

Typical Company Valuation: $150 – $200 million and up (may vary)

Common Investors: Late stage VCs, VC Firms, Banks

SERIES E

Similar to series D round, many companies go beyond further to raise series E round with similar reasons. Let’s figure out the reasons why some companies go for series D, E or beyond.

“Airbnb Invests $200 Mn In OYO’s Series E Funding Round”

Average Funding Amount: $100 million – $500 million or more (amount varies widely from startup to startup)

Typical Company Valuation: $200 million – $400 million and up (may vary)

Common Investors: Late stage VCs, VC Firms, Banks

Few positive reasons to raise series D or E round are:

- Before going to IPO, they have to create presence in new discovered opportunities, and there is a shortfall in funds as per plan.

- Few companies want to increase their valuation to a next level before going for public. Increased valuation will help them to get a good share price in public.

- Few companies want to stay private for longer till investors love to fund them. These are positive reasons to raise a Series D (or beyond) round of investment.

Few negative reasons to raise series D or E round are:

- If the company didn’t meet the objectives laid out after raising their Series C round, & incurred a loss, they might need to go for next round. This round is termed as “down round.” Andat this time,the company raises funds ata lower valuation than they raised in their previous round.

- So, if you are thinking of processing in Venture capital there are few key takeaways you should keep in mind before meeting the investors:

- You need to have full knowledge of investor’s requirements. You can easily find about their needs with some basic research.

- Do not try to hide any negative information from the investors, doing that can make you face problems in the future.

- You need to have a complete overview about what you do and for whom you do and your location.

- VCs wants to know about your team, good team of people can attract more investors.

- Keep your demo always ready.

- You need to have a full information about your customers. Know about their requirements and how will you reach them.

- Know every competitor, list the major competitors and get your solutions ready about the problem.

- You should have every details about the expenses and the expected revenues.