BITCOIN: A Risky Bubble or Smart Investment?

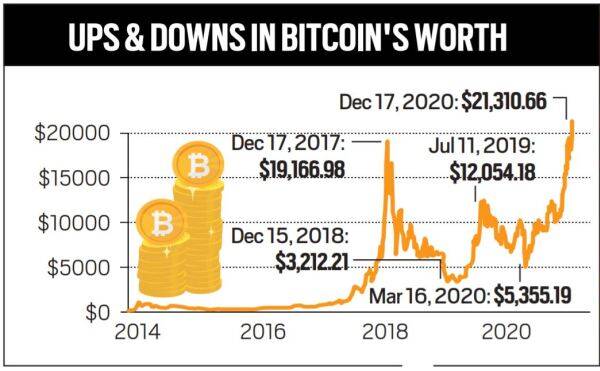

Bitcoin is undoubtedly a very risky & unpredictable investment. As per the records, bitcoin market has been very unstable. There have been numerous occasions where it spiked high and then crashed down real quick.

Understanding Bitcoin

Before diving into the investment aspect, it’s crucial to comprehend what Bitcoin is. At its core, Bitcoin is a decentralized digital currency that operates on a technology called blockchain. It allows for peer-to-peer transactions without the need for intermediaries like banks. Bitcoin transactions are recorded on a public ledger, making them secure and transparent.

The Case for Bitcoin as a Smart Investment

1. Store of Value

Proponents argue that Bitcoin serves as a digital gold – a store of value that can protect against inflation. They point to its limited supply (only 21 million will ever exist) as a reason for its potential to retain and grow in value over time.

2. Hedge Against Economic Uncertainty

Bitcoin’s decentralized nature and lack of reliance on traditional financial institutions make it an attractive option for those concerned about economic instability. During times of crisis, some investors turn to Bitcoin as a hedge against traditional assets like stocks and fiat currencies.

3. Institutional Adoption

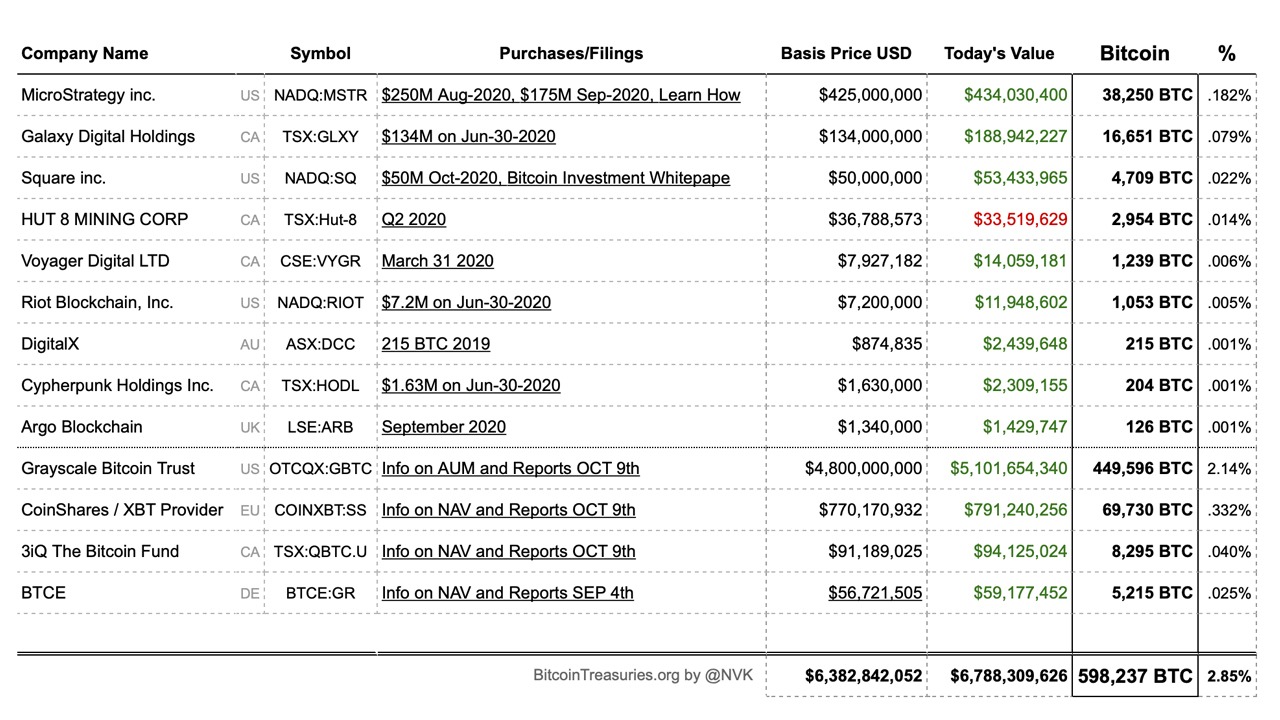

Major institutions, including Tesla and Square, have invested in Bitcoin. This institutional adoption has provided a degree of legitimacy to the cryptocurrency and boosted confidence among investors.

4. Growing Acceptance

More businesses and online retailers are accepting Bitcoin as a form of payment, increasing its practical utility. This growing acceptance could further drive its adoption and value.

The price of BTC spiked highest record of over $40,000 which pushed the value of entire crypto currency market to surpass $1trillion for the first time ever.

As per the recent value recorded, the volume of all stable coins right now is $119.87B, which is 79.83% of the total crypto market. Bitcoin’s price is currently $36,127.71 which brings it to dominance by 67.36%.

With so much hype about BTC at present, a lot of people are wondering if it’s the right time to invest. But the worry comes with the question if BTC is just a bubble and too risky to invest in.

Image source:

To Know More: What is Bitcoin and its Benefits?

The above graph shows the unstable value of BTC. It spiked to $19,166 in 2017 & crashed to $3212 in 2018. Within the span of 8 months in 2020, it spiked again from $5,355 to $21,310.

Experts says that 2017 BTC rally was very much fluctuating because it was being driven by speculation from retail investors/buyers, however, now it is predicted to be more stable since it is being driven by institutional investors/buyers.

Retail investor is an individual who buys & sells through platforms like CoinDCX, CoinSwitch, Bitfinex, ZebPay, Unocoin, etc for their own use/investment purpose. Institutional investor is an individual or an organisation that trades in large quantities. They do not use their own money, but uses others’ money for investment purpose.

Also, Bitcoin has recently received investment from financial giants which have adopted Bitcoin as a reserve asset. PayPal, Fidelity, Square, MicroStrategy , Greyscale Investments, Coinshares to name a few.

Image Source : https://news.bitcoin.com/ here-are-the-top-public-companies-that-have-adopted-bitcoin-as-a-reserve-asset/

Before investing in it, one needs to understand that if crypto-currency is regulated, monetization needs to ease up as well since no one is aware about its value. It is very much speculative right now. Experts are still wondering why it crashed back in 2018, and then spiked up four times this year.

The idea of implementing Bitcoin as a global decentralized currency has been defeated due to its speculative & unpredictable value.

Before investing, one needs to be mentally prepared that it can also come down crashing any moment. So one should invest only the amount they can afford to lose.

Conclusion: A Matter of Perspective

In the end, whether Bitcoin is viewed as a risky bubble or a smart investment largely depends on one’s perspective and risk tolerance. It’s crucial for investors to conduct thorough research, understand the cryptocurrency’s inherent volatility, and consider their own financial goals and risk appetite.

While Bitcoin has shown incredible potential as a disruptive financial asset, it remains a speculative and evolving investment. Diversification of investments and prudent risk management should be a guiding principle for anyone considering adding Bitcoin to their portfolio. As the cryptocurrency market continues to mature, its role in the broader financial landscape will become clearer, shedding light on whether it is a bubble or a smart investment choice for the long term.